Late last week Total reported Q1 2023. As with most of the OFS businesses, I have been surprised at how they have managed to maintian pricing/margins given some of the more negative headlines. It remains to be seen if this lasts for the remainder of 2023 and beyond.

Some highlights:

Rev up 42%

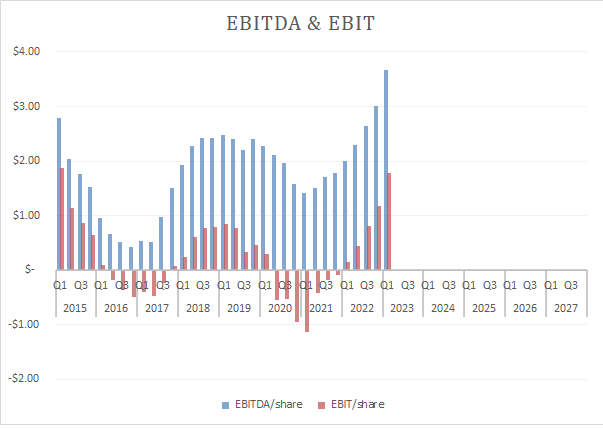

EBITDA up 77%

Strong business performance vs 2021 in all segments

Increased capital budget by $14.4 mil to $66.1 mil

Diluted shares outstanding lower by 3% yoy

There isn’t much to say about TOT (or the other OFS cos that rely heavily on activity in the short term) other than if activity stays strong and margins are maintained then the share price should perform very well. The business continues to deleverage nicely and I would expect the dividend to be increased later in the year if they remain at this level of profitability.

Valuation

TOT is trading at less than 3x EV/ttm EBITDA and about 2.5x EV/2023 est. EBITDA. Currently yielding 3.8%. Pretty reasonable.

Many of the OFS cos have been flat yoy and are still negative over the last 5 years. I believe we need some sustained business performance and at least some of the recession fears to abate before we see these move higher.

I continue to hold in my basket of OFS cos.

Thanks,

Dean