I followed Total in the past, but was encouraged to look at it again by Manana Investing on the Twitter machine.

There are more and more people interested in the Oilfield Services Cos at the moment and many of the smart investors in Twitter who are worth a follow.

I have had my position for a few months, although I still think it’s valuable for me to post some thoughts. It’s no surprise that as activity returned to the oilpatch that the OFS businesses have seen increased profits and cash flow. Total fits nicely into my basket of OFS companies due to it’s cheap(er) relative valuation, conservative capital allocation, somewhat levered balance sheet, operating leverage in the business and geographical exposure.

Background

Total Energy is a diversified energy services provider based in Calgary, Alberta. Total Energy commenced active business operations through its predecessor entity, Total Energy Services Ltd., in 1997. Over the subsequent years, the Company continued to grow its business through organic growth and strategic acquisitions. Through its wholly-owned subsidiaries, Total Energy is involved in four businesses: Contract Drilling Services, Rentals and Transportation Services, Compression and Process Services and Well Servicing. Total Energy’s operations are based in Canada, the United States of America (the "United States" or the "U.S.") and Australia. A description of each of the Company's services, including details regarding the Company's equipment, can be found below under the heading "Description of the Business".

Total acquired Savanna Energy Services in early 2017 creating one of the largest players in Canada. The takeover was a bit entertaining as Savanna was offered a friendly bid from Western Energy Services prompting Total to make a hostile takeover bid. After the crash in activity in 2015/16 there was a short lived bounce afterwards. That’s when Total completed the takeover.

Business Segments

The company is split into 4 different segments. Some highlights from each below.

Contract Drilling Services

Contract drilling services are carried out using drilling rigs and other auxiliary equipment. Contract drilling services are typically performed based on instructions from the oil and natural gas exploration and production customer which has contracted the Company.

The majority of the fleet is located in Canada.

Rentals and Transportation Services

Total Energy provides drilling, completion and production rental equipment and oilfield transportation services in western Canada through Total Oilfield Rentals Ltd., and in the United States through Total Oilfield Rentals, Inc. (collectively referred to as "Total Oilfield Rentals").

The equipment rented by Total Oilfield Rentals (which numbered approximately 9,420 pieces of major equipment as at December 31, 2021) includes 400 barrel tanks, above-ground fluid containment pools, invert tanks, centrifuges, sump tanks, premix tanks, shale tanks, flare tanks, loaders, pressure vessels, rig mats, pumps, light towers, generators and separators. Total Oilfield Rentals also maintains an inventory of small rental equipment and access matting. As at December 31, 2021, Total Oilfield Rentals owned and operated a fleet of 79 heavy trucks.

Compression and Process Services

Total Energy operates its natural gas compression services business through Bidell Gas Compression Ltd. in Canada and Bidell Gas Compression Inc. in the United States.

Bidell designs, fabricates, sells, leases, and services natural gas compression equipment to customers operating in western Canada and internationally. Historically, the substantial majority of revenues from the gas compression services business have been derived from the sale of compressor units.

Well Servicing

The Company entered the well servicing business with the acquisition of Savanna. The Company operates its well servicing business through Savanna Well Servicing Inc. in Canada, Savanna Well Servicing Corp. in the United States and Savanna Australia in Australia. At December 31, 2021, the Company operated a total fleet of 83 well servicing rigs across Western Canada, mid-western United States and Australia.

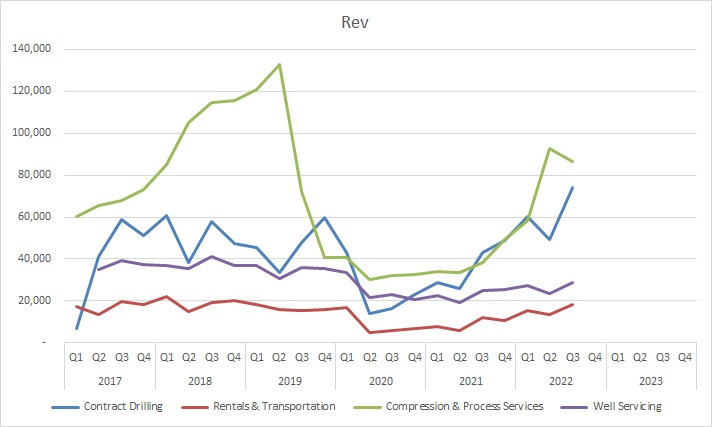

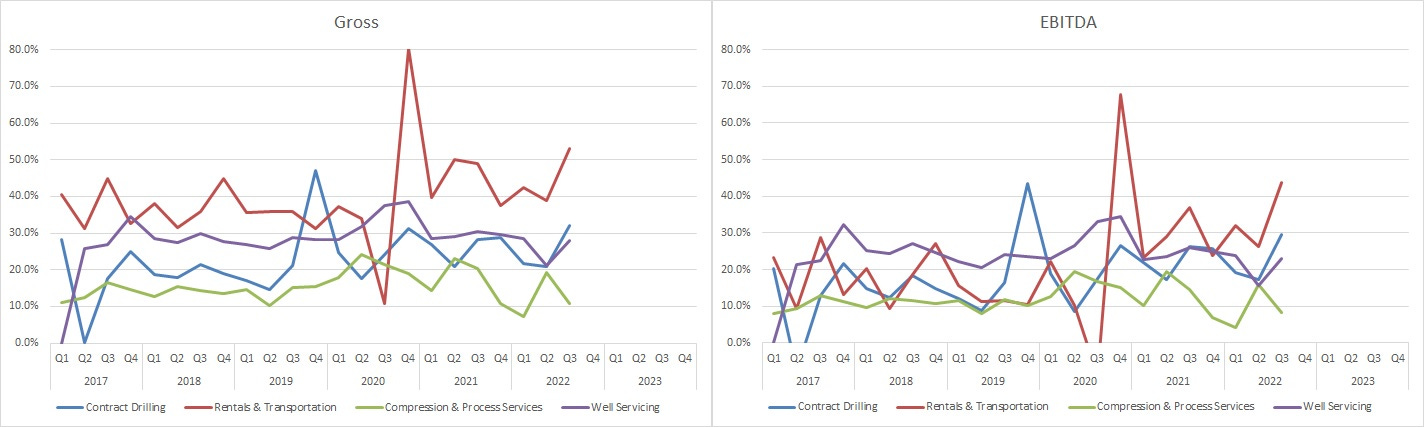

Here’s a quick look at the various segments revenue mix and ebitda margins.

Management

I don’t spend a ton of time on management and the board on these shorter term holdings. I do think the compensation is fair for both the executives and the board for this type of company. I do appreciate this requirement mentioned in the MIC.

The Corporation mandates that the Chief Executive Officer purchase and hold Shares equivalent in value to five times his annual base salary, as at the time of purchase, and that the Chief Financial Officer, the Vice President, Operations, the Vice President, Legal and General Counsel and the Vice President, Drilling Services each purchase and hold Shares equivalent in value to three times their annual base salary, as at the time of purchase. As of the record date, all officers satisfy the minimum ownership requirements.

Ownership

EdgePoint owns 18% of the shares, but this only relates to 0.25% of their portfolio. We could always see them dump this position and it could impact the share price.

The same applies to Fidelity, Invesco and Yacktman who own 12%, 10% and 6% and the holding is immaterial to the funds.

Foyston, Gordon & Payne owns 11%, although it’s about 5% of their holdings and is their top position.

The CEO owns about 6% of the company and this is many multiples of his total compensation in 2021.

Valuation

TOT is trading around 4.4x EV/EBITDA and 0.75x tangible book value. Looking ahead the valuation gets better. Looking into 2023 using analyst estimates EV/EBITDA drops to 3ish.

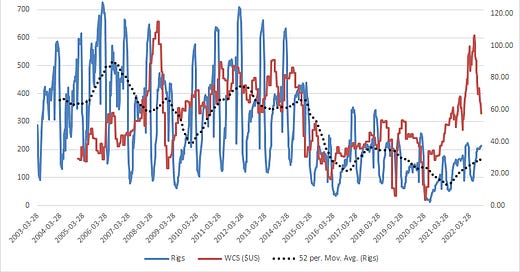

The Set-Up

With the increase in interest from more investors does have a little more nervous. The company is executing well and the business is participating in the increased activity levels. The outlook is strong at the moment which can be the wrong time to buy a cyclical. I have been observing better capital allocation across the industry so that gives me a bit more confidence in the cycle this go around. Having some debt seems to be good for these management teams as paying down debt is an easy trigger to pull. TOT does pay a dividend and I do expect them to raise it as the business continues to perform.

It’s obvious that we need to see continued investment from producers from here. Though the producers have been reluctant to invest, I do think that if oil stays above $80 we should see increased capital budgets going into 2023. Time will tell.

Shares have been range bound between $6.25-9 for the last year or so. It would be nice to see them punch through the recent high of $9.35.

Anyone own TOT.to or other OFS companies they hold in high regard?

Thanks,

Dean