Update on some holdings - $STC.to, $QIPT.to, $MCB.to, $FAR.to

There have been some developments since my last update, so I thought I would make a quick post highlighting some of the new and my thoughts.

Sangoma (STC.to) Update regarding debt repayment and NCIB

Sangoma announced that with with the most recent repayments to their Term Loan 1 that have reached the stated goal of have 55-60 million in debt but the end of fiscal 2025. They are essentially a quarter ahead of the target. They announced an NCIB for up to 5% of the common. They will be entering an automatic purchase plan with a designated broker so they can repurchase shares even during typical blackout periods.

My Thoughts

This is welcome news to me. Though I like a clean balance sheet, at some point the incremental dollar debt repayment doesn’t add as much value as when the business was more levered. Sangoma has good revenue visibility, so they should have no problem carrying a bit of debt. The automatic purchase plan is what I like to see. In my mind this put a floor on the stock, but how much upside will depend on how the business performs. I still think we will need to see some organic growth and/or a decent M&A deal for them to fetch a higher multiple.

QIPT (QIPT.to) announces Strategic Priorities for 2025

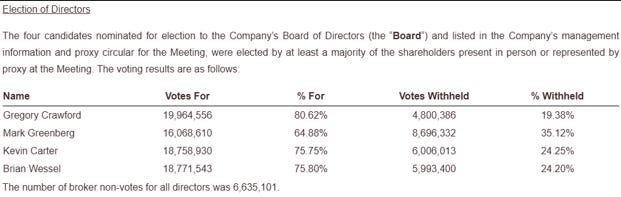

QIPT did a news release announcing their strategic priorities for 2025 as well as the voting results from the latest AGM. There was nothing major in the priorities that wasn’t already mentioned in the quarterly calls. The once thing that stood out to me was some language around M&A. They said they were in active discussions with potential joint ventures or strategic acquisitions. I think it’s worth noting that they said they plan on executing their NCIB.

The voting results are below

This does not compare favorably to last year’s results

My Thoughts

Though it’s nice to see the language around strategy and capital allocation, they need to execute on it now. The market really doesn’t care about the news release. They have negotiated a stand still with the recent activists, so if they don’t make some moves by the end of the ceasefire, I imagine the board gets overhauled. The non-reaction from the market speaks to how hated the company is.

McCoy (MCB.to) announced automatic share purchase plan

They are also allowed to repurchase during typical black out periods.

My Thoughts

This is welcome news. They obviously don’t need the capital to launch the rest of their technology roadmap, so why not buy back some shares at an attractive price. Though the business is lumpy, I think this helps reduce the downside.

Copper Breakout and Foraco (FAR.to)

Many people have been talking about gold. Copper has also recently made a multi year breakout.

I think this bodes well for the business at Foraco medium to long term. They list that 45% of their revenue is “battery metals”. I’m not sure exactly how much of that 45% is copper, but it should help as they transition to more stable clients. It doesn’t hurt that 13-15% of their business is gold miners and gold continues it’s march higher.

Anyone have a preferred way to get exposure to copper?

Thanks for reading my work.

Dean