URBANA Corp - $URB.to & $URB/A.to

Another two weeks since posting.... a couple started but I don't think they are good enough to publish yet.

Another very simple idea. Hat tip to DD for the help and data collection.

I originally posted about Urbana 10 years ago here in March of 2011. I ended up selling about 6 months later and posted about it here. Originally, I was overly attracted to the discount to NAV. I don't believe I appreciated the growth potential in NAV on a per share basis.

Background

Price - $2.99

Shares - 44.2 mil

Market Cap - $134mil CAD

Urbana Corporation is an investment fund launched and managed by Caldwell Investment Management Ltd. For its equity investment the fund primarily invests in public equity markets of United States and Canada. The fund primarily focuses on U.S. financial companies and Canadian resource companies for equity investments. The fund also focuses on private equity investments.

Private company and start-up investments are usually vetted by the board and generally at arm's length from Urbana.

Fund Perf

When looking at the performance of the fund, I am thinking about the growth in NAV. Despite the fees and annual dividend, the NAV has grown at quicker pace than the TSX. Below is the average performance in NAV growth.

Discount to NAV

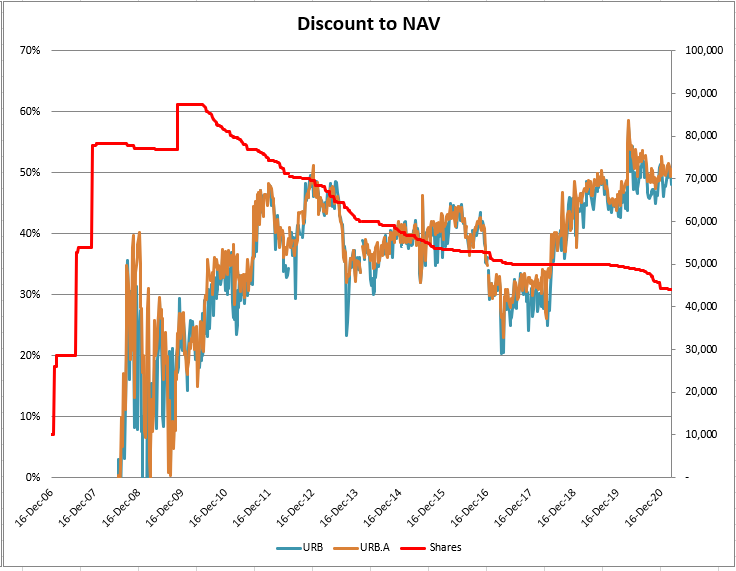

Despite the performance the, shares are trading near the largest discount to NAV in the last 15 years.

Share Structure

There are two classes of shares. 10 mil voting/common shares and 38.9 mil class A or non-voting shares. The share repurchases are from the A shares. There is more liquidity in the A class shares.

They have bought back about half the shares since 2009.

Ownership

As mentioned the Caldwell family owns the majority of the voting shares.

EdgePoint has been selling some class A shares. This could weigh on the shares, but they could also arrange a block trade and buyback the shares.

Portfolio

They are fairly concentrated. The largest 5 public equities make up 34% of assets. The top 5 private investments make up 32% of assets. The largest holding is the Canadian Securities Exchange at 13% of assets. They have had the position for many years and Brendan Caldwell is on the board. The CSE recently announced record trading volume and capital raised in Jan 2021. The marked value of their holdings was recently raised in 2020.

Mineral Properties

The company has a some mineral claims that are carried at zero value. There are 44 claims for 2,852.7 acres. So far, they have not commented on if/when this claim will be crystalized. The last time there was an update was in 2017.

Pros

Continue to buy back shares at a discount to NAV.

Pays an annual dividend. If the dividend is maintained it yields just over 3%.

The Caldwell family about $18 mil worth of the company and should be incentivized to have the shares perform.

Potential value in mineral properties.

Cons

There is a 2% investment and advisory fee (used to be 1.5%).

Dual class share structure.

Private investments may not be liquid and can be subjected to judgement by management.

As mentioned, simple idea. I'm comfortable parking some cash here in the A shares. Not a huge position, but enough to move the needle if it runs one way or another.

For those interested, you can hear the Chair & CEO share his thoughts on an audio podcast here.

Am I the only one holding some URB/A?

Thanks,

Dean

*the author is long URB/A