Viemed Q1 2022 Quick Update - $VMD.to & $VMD

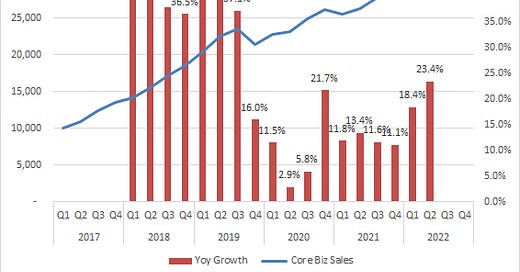

Yesterday Viemed reported Q1 2022. The results were quite good and the guidance issued for Q2 was ahead of my expectations. Some highlights (in USD):

Core business revenue hit a record of 30.2 mil

Vent rentals up about 6% yoy

Other equipment rental up over 40% yoy

Vent rentals are now 71% of revenue vs 80% last year demonstrating their diversification efforts

Entered 4 new territories

Their new staffing division already did 1 mil in revenue this quarter

They have been executing on the NCIB consistently

Guidance was for 7% sequential growth in the core business and over 20% yoy

These are all nice, but the OIG overhang is still there. As well, there is still reimbursement risk with Medicare. These have not gone away and will likely remain an overhang for the time being.

VMD is trading at less than 7x EV/2022 EBITDA, which is among the lowest it’s been since the company was split from Patient Home. I removed the full 9mil potential obligation from the OIG claim in their cash balance to be conservative. I am not sure they will get back to pre-pandemic growth due to the larger base, but it does sound like 20-30% is achievable. I like the management and the company is insulated from discretionary spending from consumers.

Anyone else own VMD?

Dean

*long VMD