*Disclosure: I own shares in VMD. I am not a professional. Please do your own due diligence.

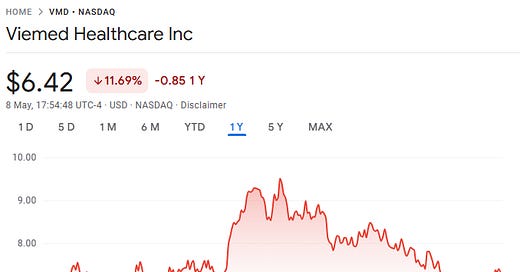

Price: $6.42 USD

MC: 267 million USD

EV: 263 million USD (not including announced acquisition of Lehan’s)

1 year performance: -11.7%

VMD reported last night and held a call this morning. The top line was a bit behind my expectations, but EBITDA was a bit ahead. Guidance was decent in my opinion. The stock is down 11.7% on the day.

*all numbers in USD unless stated otherwise

Quarter Recap

Revenue came in at 59.1 million vs 50.6 million last year

This is an increase of 17%

EBITDA came in at 12.8 million vs 10.1 million last year

A 21.6% margin

Vent patient count up to 11,809 or 13% year on year

PAP therapy patient count at 22,899 or up 7% sequentially

Sleep resupply patient count down 6% sequentially to 22,941

Up 21% from Q1 2024

They raised the low end of the annual guide to 256-265 million in revenue and 55-58 million in EBITDA

This does not include the recently announced acquisition that should close in Q3

This is in the 10-Q regarding CMS (Centers for Medicare & Medicaid Services) NCD (National Coverage Determination)

CMS released a proposed decision memo on March 11, 2025, and a final determination is scheduled for June 9, 2025, although the timing may be extended or delayed. We have actively participated in the coverage analysis process, including the submission of formal comments, and we continue to engage with CMS, the Department of Health and Human Services, and members of Congress. The issuance of a revised or new NCD that clearly defines medical necessity criteria for ventilator use could significantly affect patient access, reimbursement, and utilization of ventilator therapies, and may have a material impact on our business.

Call Notes

Ahead of where they had anticipated for Q1

Vent revenue

Down 3% sequentially

Up 10% yoy

Result of sales restructuring last year

Now 54% of revenue

Sleep

up 7% sequentially and 40% yoy

Sleep at 16% or revenue

Staffing at 10% of revenue

Oxygen at 10% of revenue

Regulatory

CMS proposed non-invasive NCD

Comments due by April 10

Acquisition of Lehan’s Medical Equipment

80 year old family owned

Respiratory care and women’s health

Relationships with payors in Illinois

Can expand their products to rest of country

Can take VMD sleep and vents into Illinois

Has 6 locations

Double digit growth in their existing locations

They are looking to increase that growth into geographies where VMD already has a presence

Lehan’s has a larger amount of resupply revenue and therefore higher EBITDA margins

Capex

Accelerated vent exchange with Phillips

Half of fleet refreshed at cost of 1 million

Capex should normalize in H2 2025

Tariffs

2025 supplies locked in

No material impact in the current year

Guide

Expect yoy increase in revenue

Sequential revenue growth of 5-9%

Not including acquisition

VA is dead

They mentioned that there has been too many changes with

Valuation

VMD is trading at about 5.2x EV/ttm EBITDA. The midpoint of their guidance gets them to 5x EV/2025 EBITDA. If we look ahead to 2026 with Lehan’s included, I get roughly 4.7x EV/EBITDA without much growth consideration.

Closing Thoughts

The CMS NCD really spooked investors. It could be very meaningful in the short term. We will have to wait and see if/how it impacts VMD. They have been through competitive bidding in the past and managed to come out the other side.

In the meantime they are executing well. The Lehan’s acquisition is a great example of what the team at VMD is capable of. It’s a great add in, expands their geographical reach and product portfolio.

Thanks for reading.

Dean

* long VMD

EBITDA beat a bit misleading as they included the gain from vent sales and stock based comp also took a large y/y jump

Great summary but I’m actually getting a bit discomfortable with the fact that they are stepping out of their “circle” into all this different ventures, sure it’s still all DME and HME but still .. I need to think more about this…