VMD reported Q2 2023 yesterday. Results were ahead of my expectations and the stock sold off a bit (-2.5%) on the news. Here is a live shot of my portfolio…

Quarter Recap

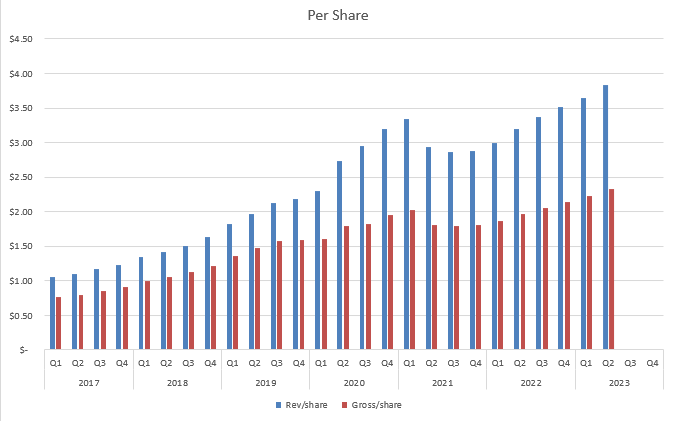

Revenue was up 31% yoy to 43.3mil USD

This includes 1 month of the recent acquisition of HMP or 2.5mil

Organic growth was 23% yoy

Vent revenue is 60% of total vs 69% last year

This should continue to trend lower as they grow the non-vent business

Topped 10,000 vent patients

60% gross margin, 22.6% adj ebitda margin

guidance for 49-52 mil for Q3 2023

Call Notes

Initial cross selling vents into HMP business have been positive

Non-vent business (oxygen, sleep, staffing) grew about 50%

They are on target for their staffing target of 115 sales reps by year end

They are currently at 112

HMP had higher organic growth (high teens to low 20s) prior to the acquisition

Feel there is opportunity to increase organic growth

No supply issues with equipment

2024 competitive bidding time has lapsed

They feel that 2025 may go without any change as well

Closing Thoughts

I am impressed with their ability to maintain margins as they diversify the revenue base. The sleep and oxygen business have lower margins although it is faster growing. The acquisition looks to be a good one so far. They are usually quite conservative so I wouldn’t be surprised if IMP performs better than originally expected.

VMD is currently trading at about 7x EV/est ebidta ntm. I think that is a more than reasonable price to pay for this business given the growth rate.

There is always the reimbursement risk, although they are less exposed to vent reimbursement than in the past.

Thanks for reading.

Dean

*long VMD.to