🧵 TL;DR — GEO.TO

Business: Geodrill (GEO.TO) is a gold-focused drilling contractor operating in West Africa, Egypt, Peru, and Chile.

Valuation: Trades at ~2.5x forward EV/EBITDA and <3x TTM—cheap by any measure.

Recent headwinds:

Wrote down junior miner receivables

Exited Burkina Faso

Temporarily suspended dividend

Now: Clean balance sheet, better client mix, strong insider alignment (46% ownership).

Macro: Gold strong, but gold equities still lagging. GEO could re-rate with a sector tailwind.

Optionality: Cheap, illiquid, and possibly for sale if the market turns.

➡️ I’ve been adding to my position. Not a professional—do your own due diligence.

Disclosure: Long GEO.TO

Price: $2.89 CAD / $2.04 USD

Shares: 47.89 million (fully diluted)

Market Cap: 97.8 million USD

Enterprise Value: 89.2 million USD

*all numbers in USD unless stated otherwise

*Disclosure: I own shares in GEO.to. I am not a professional. Please do your own due diligence.

Re-Introducing GEO

I have owned GEO for a few years at different position sizes. The last time I did a formal write-up was February 2022. While my previous GEO trades have been profitable, their overall performance has mirrored that of the TSX. I thought it would be a good time to revisit the company in a more formal way as I have been adding to my position.

Background

Geodrill provides mineral drilling to mining companies. They have a presence in West Africa, Egypt, Peru and Chile. The company has been through a few cycles and has managed to come out the other side with more rigs than they entered. The company was founded in 1998. They listed on the TSX in 2010.

Over 90% of their clients are drilling for gold.

What sets GEO.to apart

They maintain their own rigs, which isn’t uncommon for drilling companies. They minimize maintenance costs and ensure as much rig availability as possible with dedicated workshops, centralized inventory and by having a modern rig fleet. The workshop in Ghana can manufacture that can produce some ancillary equipment.

Why is there this opportunity?

Despite the strong performance of gold, the share price has not tracked. This is nothing unique to GEO as many miners and drillers exposed to gold have underperformed the spot price.

There are also company-specific issues that have weighed on the stock:

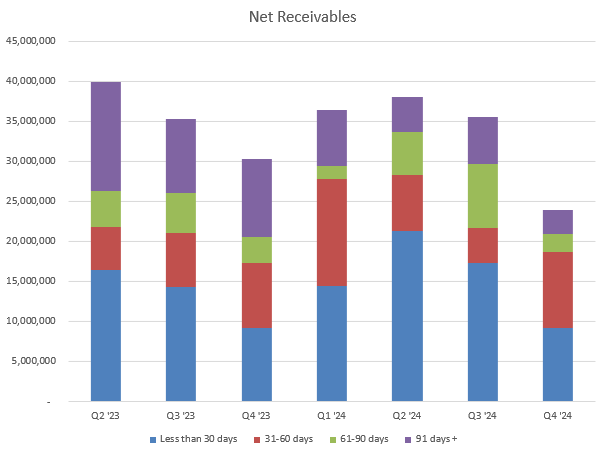

Receivables Provisions: In late 2023, GEO recorded a non-cash charge related to receivables from junior miners who struggled to raise capital. This took 3–4 quarters to cycle through, but they've since shifted focus to Tier 1 customers with lower credit risk.

Geopolitical Exits:

GEO exited Russia in 2022 post-invasion.

In 2023, they pulled out of Burkina Faso due to rising political instability, which disrupted operations as rigs were relocated.

Dividend Suspension: They paused their semi-annual dividend in 2023 during these challenges. While management has expressed intent to reinstate it, no timeline has been provided.

Seasonality: Operations in West Africa are subject to wet-season slowdowns (typically Q3), during which rigs are serviced or repositioned. This causes choppy YoY comps—something I suspect many Canadian investors underappreciate.

Balance Sheet

~$10M in debt

~$13M in cash

~$6.5M in financial assets (mostly equity taken as receivables settlement)

The balance sheet is in good shape. They have around 10 million in debt that is offset by 13 million in cash and 6.5 million in other financial assets that are primarily shares that the company accepts as settlement for trade receivables. These specific financial assets can have meaningful swings in value so this is something to consider when valuing GEO. Below are the last 4 years. You can see 2021 showed a gain of over 2 million and 2024 showed a loss of over 2 million.

They have cleaned up the receivables situation and now have a much more appropriate loss reserve compared to the balance being carried on the balance sheet.

Share Structure & Ownership

There are 47.1 million basic shares outstanding and just under 51 million on a fully diluted basis.

The CEO, David Harper, owns 41% of the common. They COO, Terry Burling, owns just under 6% and the CFO, Greg Borsk owns 1.8% of the common. The CEO owns over 55x his salary and over 20x his total compensation in value of shares. The COO owns over 13x his salary in shares and the CFO over 4x.

Together management owns 46% of the common.

Management & Compensation

All of the c-suite has been with the company for many years. The CEO has been drilling in West Africa for almost 3 decades now. He founded the company with one rig and one contract in 1998. The COO has also been drilling in West Africa for nearly 3 decades.

The company incentivizes their management team with other forms of compensation including % of their salary to reside and work in West Africa. They have an annual cash bonus that is focused on EBITDA less tax.

Board

4 board members

3 independent, 1 non-independent (the CEO)

The independents collectively own ~790K shares (~1.8%)

Board fees are cash-based

Chair John Bingham has served since 2010

Risks

Operating Leverage: As rig count grows, so do fixed costs—high utilization is required to maintain margins.

Ownership/Control: Insider ownership is a double-edged sword. A sale could happen at a suboptimal price.

Geopolitical Exposure: Most revenue is still from regions with elevated geopolitical risk.

Volatile Financial Assets: Those short-term assets can swing earnings quarter to quarter.

Liquidity: As with many of my holdings, GEO is illiquid. You may be able to get in and not get out.

Macro Backdrop

Gold tends to thrive in times of uncertainty and inflation—basically, all the time lately.

Even with solid performance from the metal, it doesn’t feel like gold equities are getting much love. It’s anecdotal, but the vibe is that gold still isn't “popular.”

As many have pointed out, gold miners have seriously lagged the price of gold itself. The charts of GDX vs. GLD over 1, 3, and 5 years paint the picture. Below is the performance of the VanEck Gold Miners ETF (GDX) relative to the SPDR Gold Trust (GLD).

Valuation

~2.5x EV/Forward EBITDA

<3x EV/TTM EBITDA

~8x FCF, even with capex-heavy fleet growth

The company continues to reinvest in its rig fleet using internally generated cash. Leverage is modest. Management is aligned. Valuation is still cheap.

Most Recent Financials

Q1 2025 results are just around the corner. I am anticipating a fairly strong quarter with some comments on guidance and (potential) tariff impact on the business. Here is the what the ttm income statement looks like.

Closing Thoughts

Things have been unpredictable under Trump. Gold (aka the boomer’s crypto) has held up well. I recently trimmed my cash balance to add to GEO.

If the market for gold and precious metals turns bullish, I wouldn’t be surprised to see GEO sold. Here’s how it’s traded vs. peers (MDI, ODG, CAPD) on EV/EBITDA:

GEO has consistently traded at a discount to MDI—understandable given liquidity, but potentially a mispricing.

Thanks for reading.

Dean

*disclosure – long GEO.to

Thanks Dean for this,

May I point out that they never operated in Russia ? You might have confused them with Foraco.

As an add on on exits, they cease operations last quarter in Mali which is another West African problematic country. Luckily, without incurring any losses as per the MD&A.

What is your take on Sustainable Capital that seems relentless in their selling ? They sold 600,000 of their stake since resuming selling in November over a 4 months period. While I do not believe they have any insights into operations, i just wonder if they will keep on selling and have no idea as to their strategy both in term of daily volume or final end game. OGD majority shareholder Alexandre was able to sell 1 M shares in a month in February/March and was taken out quickly with a block trade. In term of value this is 1.8 M versus $ 1.1 but GEO market cap is more than double OGD's.

On this quarter, Harper pretty much committed himself on a Radius interview after the year end release when he did mentioned something about shooting the lights out quarter/year or something to that effect. And he sure did mention that he would not mind selling in an interview a couple of years ago.

Anyway, with gold at the current price of gold and financing for juniors appearing to open up, would not be surprised to see fights to get a drill with a nice rerate on drilling rates. And with energy price trending lower (the other major cost for drillers after employees cost), we could have a double whammy : increase utilization rate, and increased margin ( Higher Rates and lower costs). Make it a triple whammy.

GLTA

Thanks Dean....interesting investment possibility.....would mention that these old eyes cannot 'read' the charts with black backgrounds......were they larger, then maybe....the charts with white backgrounds and bold coloured lines were great. Cheers