The HWO arrangement has officially concluded and I thought it would be a good idea to do a post mortem as I close out the arb position.

I originally posted about the HWO in June 2023. You can see the original post below.

High Arctic Special Situation - $HWO.to

Every few years I try a special situation and more often than not, I end up losing money. Thank fully the pain only lasts a few years and I manage to get through all the stages of grief just in time to try again.

I also posted a few updates along the way in January 2024 (when I made the drive to attend the shareholders meeting) and May 2024.

Background

High Arctic was/is a Canadian based energy services company. The company had essentially two different geographies. Canada and Papua New Guinea (PNG). The two business had little to no synergies so the company decided to split the business up. The arrangement had 3 pieces.

A cash distribution of up to 0.76 per share due to the sale of the Canadian well servicing business.

The PNG business which is tied to LNG projects in PNG. This was originally planned to be given as rights to the shareholders for the PNG business.

The remaining Canadian business with some cash and NOLs. To trade under the ticker HWO.

They originally announced an arrangement in their Q1 2023 earnings release. The original arrangement had no planned liquidity event for shareholders with the PNG business. Some drama ensued, including a vote to potentially replace the chair. The company went back to the drawing board and changed the arrangement.

In my original write-up, I estimated that the value was $1.52 to $2.82 when shares were trading at $1.20.

The new arrangement

The arrangement would still be 3 different pieces.

A cash distribution of up to 0.76 per share due to the sale of the Canadian well servicing business.

The PNG business which is tied to LNG projects in PNG. This would trade under the ticker HOH.

The remaining Canadian business with some cash and NOLs. This remains under the ticker HWO.

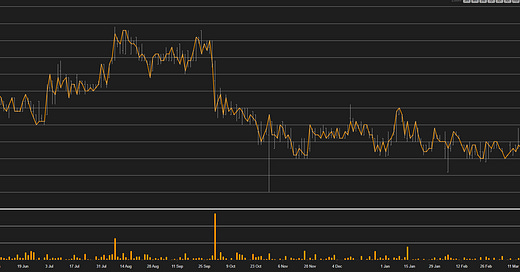

Shares drifted sideways during the months after the announcement as the original arrangement did not sit well with the shareholder base. You could have picked shares up cheaper than before the arrangement was announced.

The Results

Assume you picked up shares at $1.20 at the end of June 2023, and have liquidated the resulting positions in HWO and HOH. What were your results?

Without transaction fees or taxes you would have made $0.40 per share, which equates to about 30%. This isn’t bad, but it also doesn’t compare to some of the indexes. The rough return of the indexes is shown below.

Takeaways

I’m not sure there are any. The deal had some hair on it, but I felt the the downside was well protected. The indexes ripped, while a large portion of my original thesis (the PNG business) faces delays and uncertainties. I wouldn’t be surprised if HWO and HOH drifted higher from here.

I have gained a bit of confidence in arb type plays after this. So I have rolled some of the capital into another position that I would consider arbitrage.

Did you invest in the arb? Are there any arbs you are playing now? Let me know in the comments. I would love to hear about it.

Thanks for reading

Dean

I think your process and way of thinking about this arb play was correct, even if the IRR underperformed the index.

Liquidations and legal plays generally take longer to play out than expected. At least in my experience. I am living this now with MEEC.

I’ve set up a Google alert for “CVR” and “contingent valence right.” On a risk/reward basis the best arbitrage plays going. By acting quickly you can usually lock in a spread on the takeover, so you get paid to take the CVR. They don’t always pay out but when they do it’s a beautiful and lucrative thing.

Congrats Dean, 30% irr is nothing to sneeze at. Though it could've been a lot higher had the insiders not tried to screw minority shareholders.

I made this my largest position and now looking back I think the decision was correct even though the return is not as high as I had expected. I sold all my hwo shares which I had always assigned zero value. Thought about rolling into more hoh but decided against it and will just keep my current hoh shares. I do think hwo is overvalued and hoh is undervalued but with lots of uncertainties.

Anyway good work as always. I benefited tremendously from your blog, from this idea and also in general. Thank you