Like MCB, I own TOT in a basket of OFS cos. I originally did a quick write-up in Nov 2022. Results this quarter were weaker than expected and the stock sold off a bit. Given the weaker than expected quarter, shares are back below $10 and (like many OFS cos) seem to be range bound.

Quarter Highlights

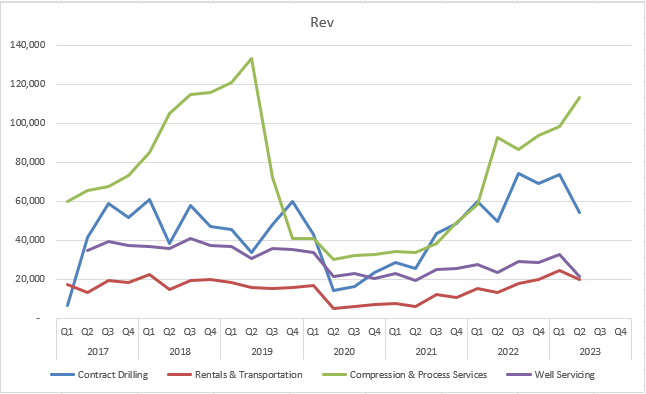

Rev up 17%

Ebitda up 5%

Weakness was in Compression & Process Services (CPS) and Well Servicing (WS)

Removing a contract cancellation from last year’s quarter in CPS, the results were not bad

WS down due to lower well abandonment in Canada as the government incentives ran off as well as a rig pulled out of Australia for recertification and upgrades

They disposed of some equipment in the Rental and Transport (RTS) segment

Capex budget was raised by 6mil to 72mil to meet demand

Call Notes

CDS segment stable yoy from a margin standpoint

Pricing for rigs in North America is stable

Lower backlog in CPS isn’t a concern at this point given the strength from prior quarters and overall demand is strong

Closing Thoughts

Despite missing expectations I feel the story is still intact here. They reiterated demand is still strong. Like STEP there is a deleverage story here as well, so we could see the multiple creep up as they become less levered. Throw in a dividend and an NCIB I think there is a floor in the share price.

Having said that I will be watching the backlog in CPS and activity in the WL segments. These two segments were over half the consolidated revenue so they will move the needle if lagging.

I continue to hold my shares.

Thanks for reading.

Dean

*long TOT.to