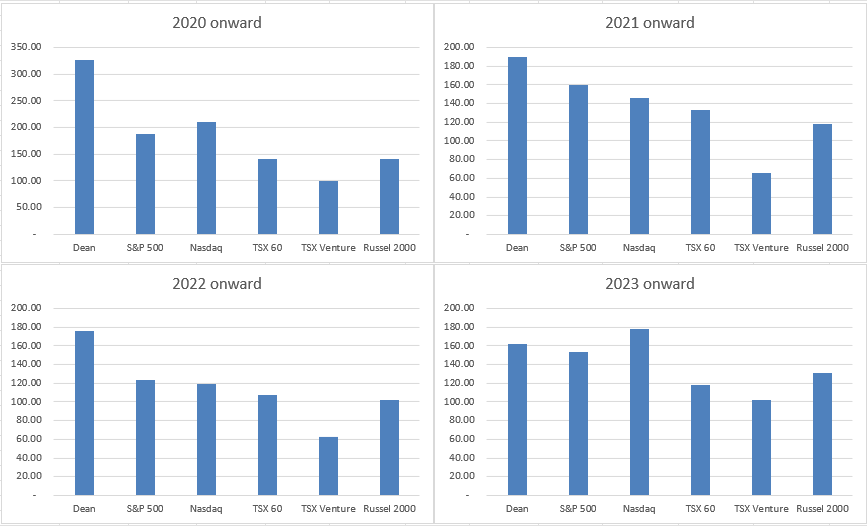

Q3 was good, carried mainly by Cipher. The portfolio was up 23.1% for the quarter and ended Q3 up 42.2% YTD. This compares positively to the indexes. It also shows what the value of $100 invested at the start of the last 4 years would have been worth.

As a reminder I run quite concentrated which leads to some pretty big swings in performance. This isn’t for the faint of heart.

Cipher Pharmaceuticals - CPH.to

78% in Q3, +157% YTD

I recently did a review post on Cipher so I won’t go into detail here. Click on the article below to see it.

CPH Update

Well well well, how the turntables turn. I don’t actually know if that works here, but I’ve always wanted to start a blog post that way. Anyway, let’s get to Cipher.

Viemed Healthcare - VMD

+16% in Q3, -5% YTD

6.4x EV/2024 EBITDA

Really not much has changed for this one. There are still concerns with impact of GLP-1 drugs long term. There is always the competitive bidding risk with VMD. Really I could just leave the comments from last quarterly update.

Steady as she goes here. I believe the market is concerned about GLP-1 drugs and potential competitive bidding for this business. So far GLP-1 drugs have proven to be a short and medium term tailwind. When someone seeks a prescription for GLP-1 drugs, they are likely placed on a comprehensive plan for their health which includes the drugs and potentially some sort of solution that VMD supplies.

OFS Basket (PHX.to, TOT.to, STEP.to, PSI.to, PSD.to, MCB.to)

-4ish% in Q3, +12ish% YTD

I also went back over my thoughts on oil recently. Have a look if you want some more detail.

Though I have been wrong on the activity levels for O&G, the performance in aggregate hasn’t been awful.

Sangoma Technologies - STC.to

+18% in Q3, +84% YTD

5.4-5.9x EV/EBITDA(guided)

Despite the strong performance in the stock this year, I still think there is room for upside. They guided for a small amount of growth for 2025 (though I think they are being conservative). The valuation is dirt cheap, but there isn’t much for the market to get excited about. The new CEO spent the last year on re-aligning operations after their many acquisitions. They just recently starting re-engaging customers and channel partners with the new “refreshed” Sangoma.

RediShred Capital - KUT.v

+23% in Q3, +31% YTD

7.1x EV/2024 EBITDA, 11.5x EV/2024 FCF

KUT is finally lapping better paper prices. The scheduled shredding services is growing well and should provide some nice operating leverage moving forward. The market is slowly waking up on the company. I’m hoping the market wakes up to KUT here. As with STC, a small buyback would move the shares. For KUT I think it’s even more important for them to get the share price higher as at some point in the future they likely do a raise to continue the roll-up strategy.

Foraco International - FAR.to

-5% in Q3, +10% YTD

3.1x EV/ttm EBITDA, 6x EV/ttm FCF

Q2 came in weaker than I was expecting. They don’t have much exposure to lithium which I confirmed when I chatted with the CEO in September. I am not expecting a strong remainder of the year, but I do expect 2025 to be better than 2024. The continued deleveraging coupled with a buyback could really turn the story around.

Geodrill - GEO.to

+12% in Q3, +47% YTD

3.8x EV/2024 EBITDA

GEO seems to have worked through the majority of the transition away from juniors or higher risk clients. The receivables situation looks to be under control here. Looking forward to seeing some capital roll into the sector. I’m glad I didn’t sell my shares (and even added a small amount) when they had the issues with receivables.

Quipt Home Medical - QIPT.to

-12% in Q3, -45% YTD, down about 11% from when it was profiled

3.2x EV/2024 EBITDA, 5.8x EV/2024 FCF

I think this company shows what happens when you buy something optically cheap with lots of negative newsflow. You have a real chance of the stock continuing to drift down. Which is why it’s prudent to wade into these slowly. Though a small position, I see potential here. I continue to build my position on weakness here. Lots of worries for the market to focus on.

OneSoft Solutions - $OSS.v

+23% in Q3, +19% YTD

6.4x EV/2024 Rev, 4.9x EV/2025 Rev (my estimate)

OSS announced they plan on being acquired. Looks like the deal goes through here. I will recycle the capital back into some other ideas.

Closing Thoughts

There are a couple of positions that I am building out and not mentioned here. I am not 100% sure I will own them in any meaningful way so I will wait to mention them.

I am happy with the portfolio here. I would say the businesses are performing well.

How did you do in Q3?

Thanks for reading.

Dean

*long all companies mentioned at time of writing