Rig Count Quick Update

It’s been quite a while since I did an update on the rig count. For those interested I made 3 separate posts previously that you can take a look at; Canada, USA, and International.

The EIA is predicting total global production of 100.09 and 101.28 mbpd for 2022 and 2023 with consumption coming in at 99.53 and 101.50 mbpd. This is obviously overly simplistic but supply and demand remains tight despite some economic headwinds.

Given a quick look at the rig count vs. price for Canada.

Looks like it will be a busy winter here in AB for oilfield workers. This is of course as long as we don’t run into pipeline capacity constraints.

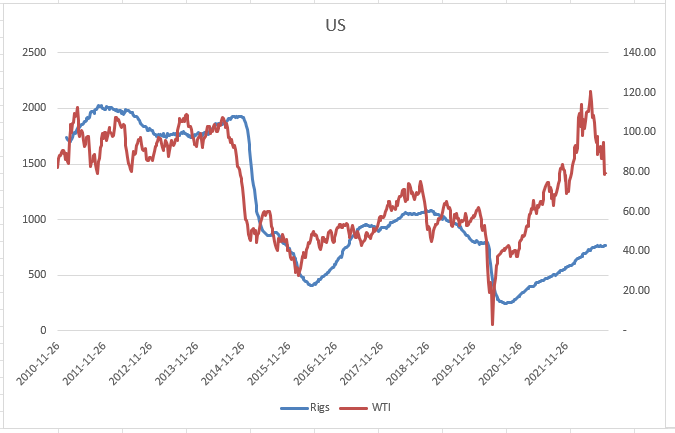

And here is the USA.

As I said previously, this is an overly simplistic way to look at this. However, I think it’s reasonable to use these data points coupled with other information (including other commodities with similar supply/demand characteristics) to get an idea of which way activity levels are likely to move.

I deploy capital in OFS using a basket strategy. I have some names in a full position and one or two I am adding to the portfolio or topping up existing positions. My timeframe is 9-24 months.

Risks to activity

It goes without saying that despite the lack of investment in recent history, price can only go so high before demand is impacted enough to prevent capital from being deployed by the majors.

This is a cyclical commodity so a recession will likely mean a decline in price at least in the short to medium term.

OFS companies are subject to high inflation like the rest of us. There is a risk that their costs will rise faster than their top line.

So far the industry has not been subject to renegade capital management. Everyone (or at least everyone important) seems to be playing well and being disciplined. This can change and the last thing the industry (and my stocks) need is some unjustified ramp in activity.

Political/ESG is always a risk with hydrocarbons.

Another Note

The last thing I wanted to point out is how the media (and social media) fixate on the dialogue from various representatives; whether that be Biden, OPEC, etc. I am going to do my best to stick to the facts. Though on the margin, OPEC does have the spare capacity to throttle production up or down. With supply this tight, that production matters more and more.

As a % of total global production, OPEC produces less than 30 years ago. Therefore to me they are (potentially) in a position of less power.

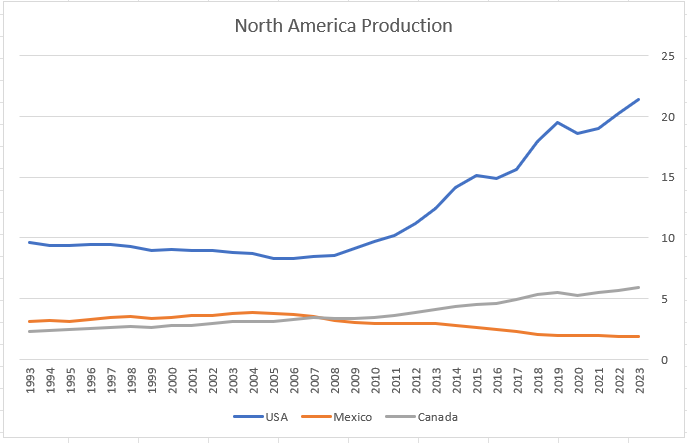

The USA has increased production in the last 30 years, although they still imported something like 40% of their consumption. Check out this post from Visual Capitalist.

It’s amazing how quickly the production from the USA rose after being stagnant. Thank you fracking.

Consumption is being driven by non-OECD countries (pretty sure everyone knows this).

Summary

Definitely nothing earth shattering here in the post, but I thought it would be good for me to get some of my thoughts out in the open.

Let me know if you have a favorite company that will benefit from increased activity levels or if you think differently. Or don’t, it’s up to you.

Thanks,

Dean